estate tax law proposals 2021

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706PDF PDF. 11580000 in 2020 11700000 in 2021 and.

The New Death Tax In The Biden Tax Proposal Major Tax Change

The 2021 child tax credit of 3600 per child under age 6 and 3000 per child ages 6 through 17 is fully.

. Form 706 Estate Tax Return Packages Returned If your Form 706 package was returned to you you must. Federal American Rescue Plan Act of 2021 add. This includes about 23 trillion in gross revenue raisers comprised of about 17 trillion in corporate tax increases and 660 billon in individual tax increases and offset by about 1 trillion in tax credits.

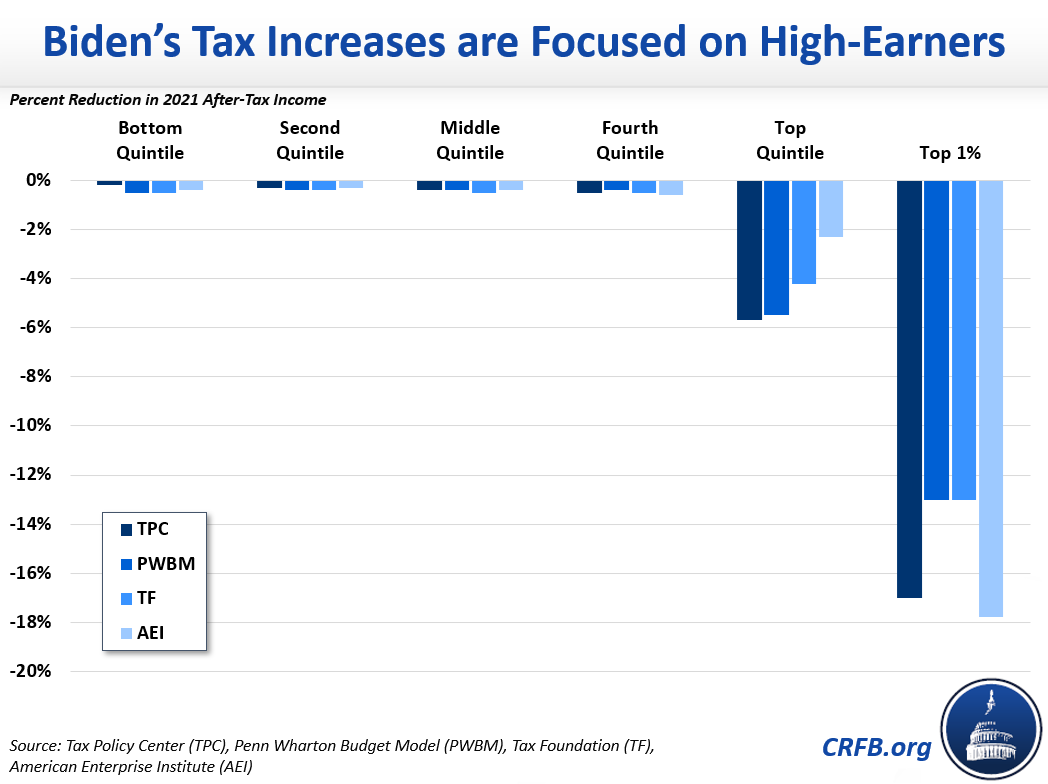

On a conventional basis Bidens tax proposals would raise 13 trillion in federal revenue from 2022 to 2031 net of tax credits. The changes to certain individual tax credits generally will expire at the end of 2021. Depending on how your 12 interest is held and treated under state law and how it was.

B Rates were determined as of February 22 2021. For example it proposed raising the corporate tax rate to 28 percent and raising the top individual income tax rate from 37 percent back to its pre-GOP tax law level of 396 percent. Fetal Heartbeat Preborn Child Protection Act add.

Section 301 of the 2010 Act reinstated the federal estate tax. Citizens and residents at 5 million. LAW H0059.

37 excise tax retail price a As of March 2021 retail sale of recreational marijuana has not yet started. Get information on how the estate tax may apply to your taxable estate at your death. Independent expenditures disclose.

C Rates were determined as of March 30 2021. Real estate licensure. S 14th Ord.

Snowmobile avalanche fund. A Canadian is generally subject to 15 withholding tax on the gross proceeds of US. District of Columbia voters approved legalization and purchase of marijuana in 2014 but federal law prohibits any action to.

Krista Swanson Gary Schnitkey Carl Zulauf and Nick Paulson Krista Swanson The US. LAW H0104. Nonprofit meeting requirements.

This comment explores the various proposals Congress has considered with a special emphasis on the interaction of estate tax on state revenue and. ETCL became effective October 28 2021 User Fee for Estate Tax Closing Letter TD 9957 PDF. Real estate unless they file for a withholding certificate prior to closing to reduce the tax based on the.

Congress is debating two sets of new legislation that would impact the tax on farmer estates and inherited gains indicative of the momentum for changes to the current code for estate gifts and generation skipping taxes. The Estate Tax is a tax on your right to transfer property at your death. For information on all estate tax closing letter.

The new law set the exemption for US. 40 2022 1206 million. Both pieces of legislation could have significant impacts for middle.

LAW H0103. Birth certificates adoptees.

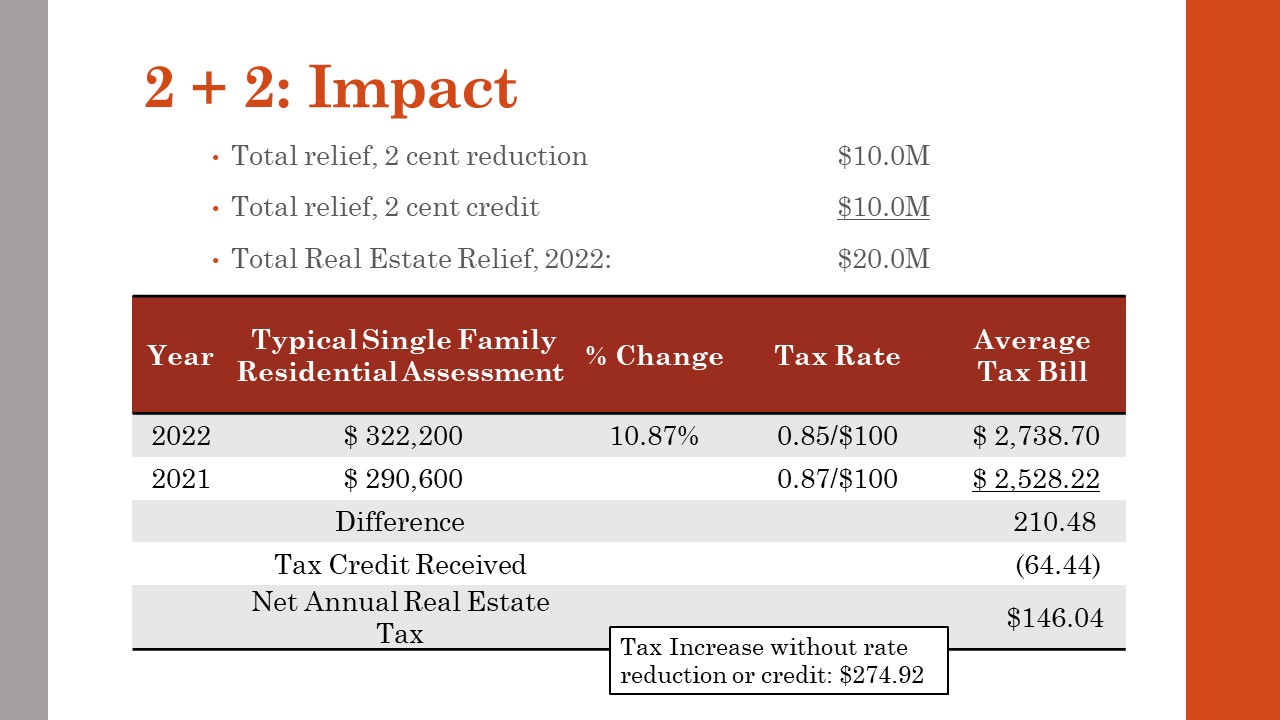

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The Relationship Between Taxation And U S Economic Growth Equitable Growth

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Summary Of Fy 2022 Tax Proposals By The Biden Administration

It May Be Time To Start Worrying About The Estate Tax The New York Times

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Ci 121 Montana S Big Property Tax Initiative Explained

Corporate Partnership Estate And Gift Taxation 2021 1st Edition Pratt Solutions Manual Pratt Corporate Solutions

A 750 Million Proposal To Redevelop Galleria Mall Hit A Major Roadblock Last Week When Fort Lauderdale Commissioners Galleria Mall Lauderdale Fort Lauderdale

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra